Change How YOU Trade Forex – Forever!!!

Have you ever bought trade after trade all the way down? But then after you finished trading you asked yourself… why was I buying, it was in a down trend? If you have, don’t feel bad… we’ve all done it…

Buying When YOU Should Be Selling!

The reason why traders lose most of the time. Is because they’re buying when they should be selling. Or they’re selling when they should be buying. The fact is – most traders want to trade against the trend – resulting in loss, after loss, after loss!!!

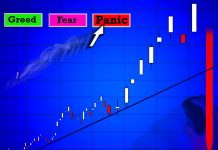

So why do you make the same mistakes over and over again? The reason – Fear! We fear that if we sell in a down trend, you will sell at the bottom, and lose! You fear that if we buy in an uptrend, you’ll buy at the top, and lose!

Traders Pick The Tops All The Way Down.

So instead, we try and pick the top all the way up. Or we try and pick the bottom all the way down – losing trade after trade! Does all this sound familiar? If it does, we feel your frustration, we feel your anxiety, and we feel your anger!

If you fall into the 95% of day traders who lose day after day – the good news is: Trading divergence is going to change all that! In fact, we’re so confident you’ll learn how to turn your BAD trading habits into GOOD ones – we guarantee it!

You’ll Go From A Losing Trader To A Winning Trader.

They say the trend is your friend – until it ends! Trading divergence will show you how to enter your trades in just the right place each & every time. Plus you’ll be trading with the near term trend – just like that! Better yet, you’ll go from a losing trader to a winning trader – in no time flat! And, you’ll start making winning trades week after week – just like that! No ifs, – or butts about it!

Trading using the divergence strategy is one if not the best strategy. Because you can trade with the trend. Or against the trend. The choice is yours. And because we enter our trades just after the Central Banks take out the stops. We have an edge when trading the Forex Market… using divergence.

Central Banks taking out traders stops.

Why? Because this formation of higher highs on the price chart. Or lower lows. Is the Central Banks taking out traders stops. Is a part of the divergence strategy formation. That’s right. The actual formation of divergence. Without the banks hunting down the stops. We would not see divergence on each turn in the market. Instead all we would see is 1 low. Or one high. That’s it.

Double Top And Double Bottom Divergence.

But because we only covered ‘Regular Divergence.’ We can’t forget about Double Top and Double Bottom Divergence. Now can we? Double Top and Double Bottom divergence is a totally different story. Why? Because the Central Banks don’t hunt down traders stops. Instead they just scare the day lights out of traders by coming within a few pips of your stop.

Buy Low And Sell High.

And when trading ‘Hidden Divergence’ it’s even scarier than trading the other two forms of divergence. Because your entry will always be near the top of the day. Or the low of the day. And we all know that buying at the Top. And selling at the Bottom. Is a no, no! Successful traders are known to “Buy Low And Sell High!”