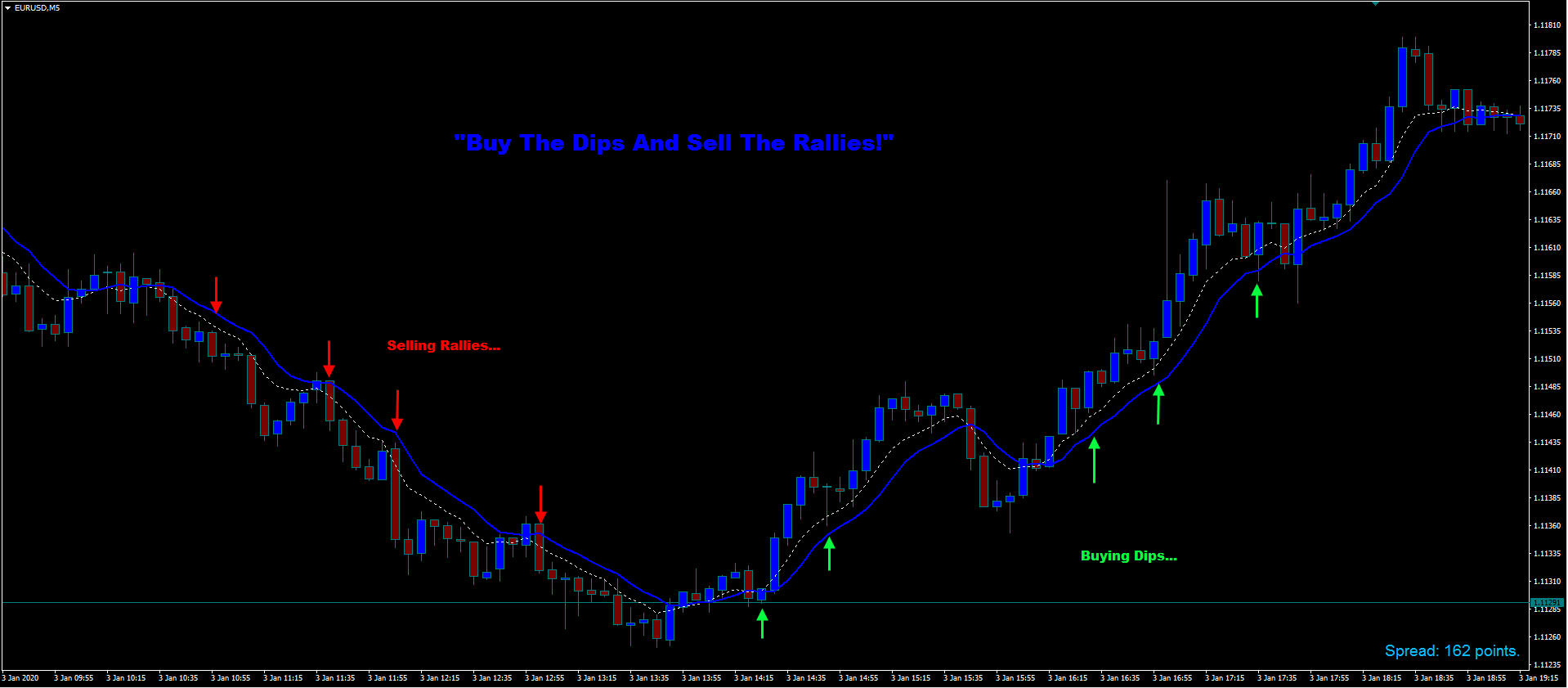

“Buy The Dips And Sell The Rallies!”

Most Forex Market traders entries are based on strength and weakness. Meaning. They want to see the market run in there favor before they enter their trades to make certain that they are correct.

When traders buy and go long they like to see the current price go up before buying. Or. If selling short they like to see the current market price go down before they enter the trade. Known as strength and weakness.

The problem is they don’t realize that they are entering their trades at a point where the current market price is just about to have a pullback causing the trader to suffer in draw down.

You Need To Buy When The Current Trend Is Up And Sell When It’s Down!

What they really should be doing is first to pay close attention what the current trend is and only trade with the trend. But! They need to buy a dip when the current trend is up. And if selling short. They need to be selling when the current market price is going back up.

I know this all sounds very confusing but in reality it make perfect logical sense to an experienced trader. When I was first told this it made no sense to me. A good trader friend from Chicago explained it to me.

You see. It makes total sense and let me tell you why. It’s a lot easier to sell when the price is going up because a lot of traders are getting out of their short positions thinking the price may have hit bottom.

Buying When The Price Is Going Down. And Selling When The Price Is Going Up!

Buying when the price is going down in a bull trend is the exact opposite as traders are getting out of long trades thinking a top market price maybe in the cards.

And another good point to make is simply this. What would you rather do? Sell at the bottom and expose your trading account to more risk. Or. Sell at a higher price where there is less risk of loss?

When You Buy Or Sell At A Better Price Equals Less Risk!

See how this works? Professional traders “Buy The Dips And Sell The Rallies!” Why? Because they get more pips in a trade and they reduce the chance of greater losses. The closer you are to your entry point the less risk you will take. But you must be trying to trade with the current trend otherwise you will be a dead duck sitting in the water.

Like I said above this can be very confusing. Because what is he trying to tell me? To buy when price is going down. And sell when the current price is going up? Well, let me show you because illustrations are always easier to make sense out of than reading.

Once you master this I promise you will never buy on strength. Or sell on weakness again! Why buy or sell when the current market price is about to reverse and make you suffer in draw down. You rather get in on a trade where the current market price will automatically go in your favor as soon as possible.