How To Trade Pivot Points With Ease!

Pivot points are used by all kinds of traders from Futures Traders to Forex Traders. They are basically based off of the high, the low, and the closing prices of previous trading sessions, and they’re used to predict support and resistance levels in the current or upcoming session.

But more importantly, they are used as entry points and exit strategies. And I am going to go into great detail just how to use them to your benefit. Plus I will teach you how to use them so you can reduce losses.

If you google the word ‘Pivot’ they will basically tell you what I just told you in the first paragraph above. Sure it explains how they are calculated but what good is that if you don’t know how to use them properly – now does it?

Learn How To Use The Pivot Correctly!

You see, it’s like having a lock pick to pick a lock without the skills on just how to pick that lock. You are stuck with a useless tool right? Right! So, let’s get right into it now. That we know how they come up with these different price levels each day. Which start the day at 5:00 PM eastern Standard Time. If you run them on a brokers platform that they start the day at say 12:00 PM midnight. This will cause the wrong pivot point and price levels to be incorrect.

It is extremely important to have them calculating the correct prices levels at the correct time of the day which is 5:00 PM.

Fibonacci Pivot Points Are Very Accurate!

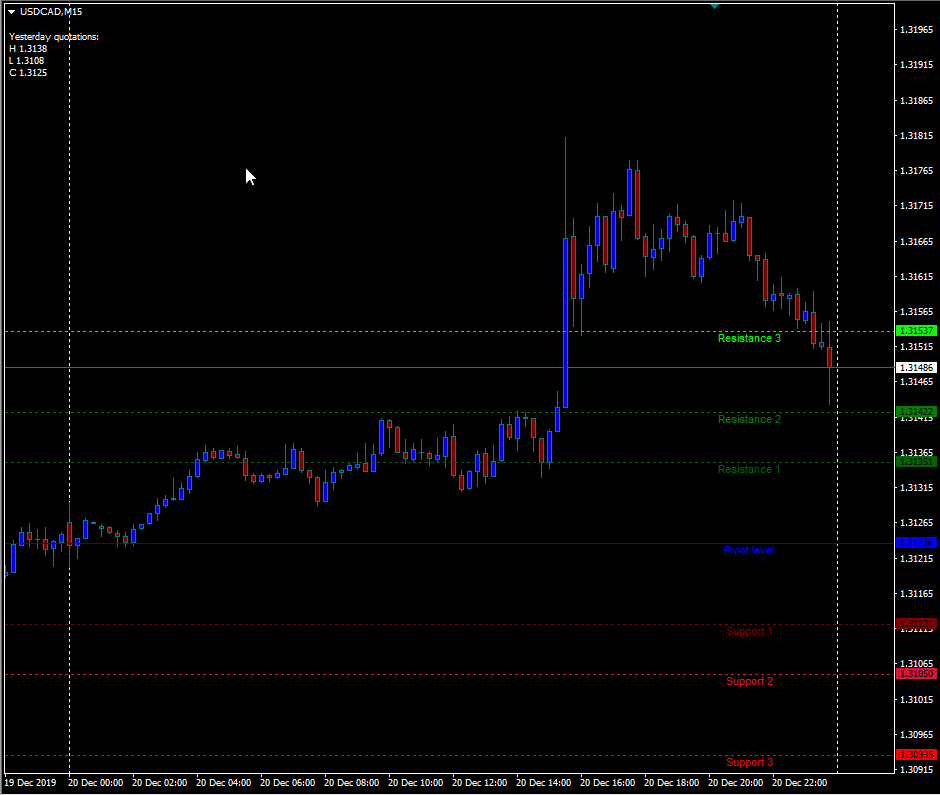

Since I trade Forex I use the ever famous “Fibonacci Pivots.” Why you ask? Plain and simple the majority use them to base their trades off of is the reason why. The indicator I use was coded for the Meta Trader 4 platform. It’s made up of:

The Pivot. Resistance 1. Resistance 2. And Resistance 3. Which these 3 price points are above the pivot. Also, we have Support 1. Support 2. And Support 3. Which are the three price points below the Pivot point.

When the pivot and the support and resistance levels are printed and calculated for the next day. If the price opens below the pivot of the blue line. We are looking to ‘Sell’ that instrument if the price runs up to the main pivot point.

When the pivot and the support and resistance levels are printed and calculated for the next day. If the price opens above the pivot of the blue line. We are looking to ‘Buy’ that instrument if the price drops down to the main pivot point.

Professional Traders Buy Off Of Support And Resistance!

What is the reason for this? Simple! Professional support and resistance traders buy off of support and sell off of resistance would be the honest answer. A trader who does not know how to trade ‘support and resistance.’ Would be left confused trying to trade with a tool such as pivot points without this critical information.